Cit bank minimum balance – Citibank minimum balance requirements, often overlooked, significantly impact account holders. This review delves into the complexities of Citibank’s minimum balance policies, exploring the various account types, associated fees, and the consequences of falling short. We analyze the effectiveness of Citibank’s support systems and compare their policies to competitors, ultimately questioning the fairness and transparency of their approach.

The provided Artikel details Citibank’s minimum balance requirements across different account types, highlighting penalties for non-compliance. It explores strategies for maintaining balances, compares Citibank’s policies with competitors, and examines available customer support resources. However, a crucial missing element is a comprehensive analysis of the ethical implications of such fees, especially their disproportionate impact on lower-income customers.

Citibank Account Minimum Balance Requirements: Cit Bank Minimum Balance

Source: disway.id

Understanding CIT Bank’s minimum balance requirements is crucial for avoiding fees. If you’re looking for alternatives with potentially more attractive terms, consider exploring business checking options; for example, check out the current Huntington Bank business checking account promotions to see if they better suit your needs. Ultimately, the best choice depends on your specific banking activity and financial goals, so comparing various options before deciding on a bank is recommended.

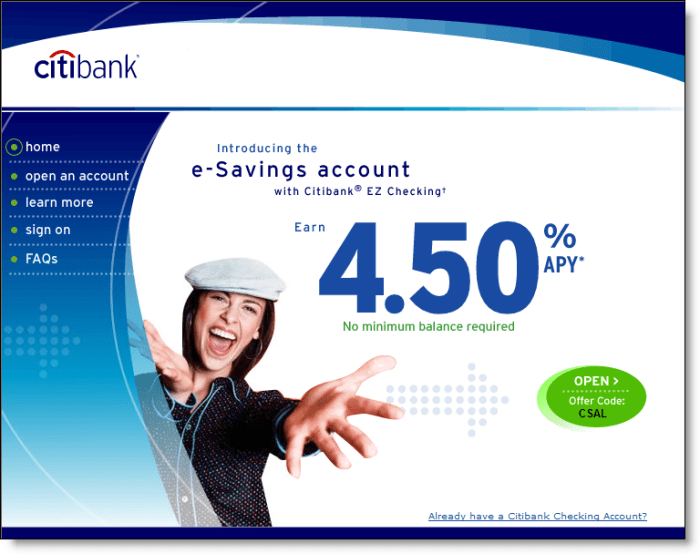

Maintaining a minimum balance in your Citibank account is crucial for avoiding potential fees and ensuring smooth financial management. This article provides a comprehensive overview of Citibank’s minimum balance requirements, the consequences of falling below them, strategies for maintaining sufficient funds, and a comparison with other major banks. We also detail Citibank’s customer support resources and offer a visual representation to aid understanding.

Citibank Account Types and Minimum Balance Requirements

Citibank offers a range of personal and business accounts, each with its own minimum balance requirements and associated fees. Understanding these requirements is key to avoiding unexpected charges.

| Account Type | Minimum Balance Requirement | Monthly Service Fee (Below Minimum) | Notes |

|---|---|---|---|

| Personal Checking | USD 1,500 (Example) | USD 25 (Example) | May vary based on specific account features. |

| Personal Savings | USD 500 (Example) | USD 10 (Example) | May have exceptions for certain age groups or account holders. |

| Business Checking | USD 5,000 (Example) | USD 50 (Example) | Requirements often higher than personal accounts. |

| Business Savings | USD 2,500 (Example) | USD 25 (Example) | May vary based on business size and type. |

Please note that these are example figures and actual minimum balance requirements and fees may vary. It’s crucial to check the specific terms and conditions of your account with Citibank.

Consequences of Falling Below the Minimum Balance

Failure to maintain the required minimum balance can result in significant financial penalties. These penalties can quickly accumulate, impacting your overall financial health.

Citibank typically imposes monthly service charges for accounts falling below the minimum balance. Additionally, overdraft fees may apply if you make transactions exceeding your available funds. These fees can range from USD 25 to USD 35 per occurrence, depending on the account type and the number of overdrafts.

For example, consistently falling USD 100 short of the minimum balance for a checking account could result in a USD 25 monthly service fee, adding up to USD 300 annually. Coupled with potential overdraft fees, the financial burden can be substantial.

Strategies for Maintaining the Minimum Balance

Several strategies can help customers consistently maintain their minimum balance requirements and avoid unnecessary fees. These strategies can be categorized into budgeting, automated transfers, and alternative banking options.

- Budgeting: Create a detailed monthly budget to track income and expenses. This allows you to anticipate potential shortfalls and plan accordingly.

- Automated Transfers: Set up automatic transfers from a savings account or other funding source to ensure your checking account always maintains the minimum balance.

- Alternative Banking Options: Explore options like online banking and mobile apps for easy balance monitoring and transfers.

- Financial Planning Software: Utilize budgeting apps or financial planning software to monitor your account balance and receive alerts when it falls below the minimum requirement.

Comparison with Other Banks’ Minimum Balance Requirements

Minimum balance requirements vary significantly across different banks. Comparing Citibank’s requirements with other major institutions provides valuable context.

| Bank | Account Type | Minimum Balance Requirement (Example) | Monthly Service Fee (Below Minimum) (Example) |

|---|---|---|---|

| Bank A | Checking | USD 1000 | USD 15 |

| Bank B | Savings | USD 500 | USD 10 |

| Bank C | Checking | USD 1200 | USD 20 |

These are example figures and actual requirements may vary. Factors influencing minimum balance requirements include operating costs, competition, and the bank’s target customer base.

Citibank’s Customer Support Resources Regarding Minimum Balance

Citibank provides various resources to assist customers with questions or concerns regarding minimum balance requirements and associated fees.

Customers can access support through phone, online help centers, and in-person branch visits. The online help center typically offers FAQs, articles, and tutorials related to account management and fees. For complex issues or disputes, contacting customer service directly via phone is recommended. A step-by-step process for resolving disputes usually involves providing account details, explaining the issue, and providing supporting documentation.

Visual Representation of Minimum Balance Impact, Cit bank minimum balance

Source: amazonaws.com

A line graph could effectively illustrate the relationship between account balance and monthly service fees. The x-axis would represent the account balance, and the y-axis would represent the monthly service fee. The graph would show a step function, with the fee remaining zero until the balance drops below the minimum threshold, at which point the fee jumps to the predetermined amount.

The graph would clearly show how maintaining a balance above the minimum avoids fees, while falling below leads to a sudden increase in charges.

Ultimate Conclusion

Source: akamaized.net

Citibank’s minimum balance policies, while clearly defined, present a significant financial burden for many customers. The lack of sufficient flexibility and the potentially harsh penalties raise concerns about fairness and transparency. While the bank offers resources to help customers manage their accounts, the overall system necessitates a more nuanced approach that considers the financial realities of its diverse customer base.

A more customer-centric approach, potentially involving tiered fee structures or more generous waivers, would be a significant improvement.