CIT Bank market cap, a crucial indicator of the bank’s financial health and investor confidence, fluctuates based on a complex interplay of factors. Understanding these factors—from interest rate changes and economic conditions to investor sentiment and regulatory shifts—is key to grasping CIT Bank’s current valuation and predicting its future trajectory. This analysis delves into the intricacies of CIT Bank’s market capitalization, exploring its past performance, present standing, and potential future scenarios.

We’ll examine key financial metrics, compare CIT Bank’s market cap to its competitors, and analyze the impact of major events and announcements on its stock price and overall valuation. The analysis will also consider the role of investor sentiment, both from traditional sources like analyst reports and from the more recent influence of social media. Finally, we’ll attempt a reasoned forecast of CIT Bank’s market cap, acknowledging the inherent uncertainties involved in any such prediction.

Yo, so Cit Bank’s market cap is kinda blowing up, right? But before you dive in, figuring out which Cit Bank account type suits you best is key. Check out the different options available here: cit bank account types to maximize your gains. Knowing your account type helps you understand how that market cap impacts your personal finances, so get that knowledge game strong!

CIT Bank Market Capitalization Analysis

This analysis delves into CIT Bank’s market capitalization, examining its current value, influencing factors, stock performance correlation, investor sentiment, and future projections. We will utilize publicly available financial data and reports to provide a comprehensive overview.

Current Market Capitalization of CIT Bank

Determining the precise, real-time market capitalization of CIT Bank requires accessing live stock data from reputable financial sources. Information such as share price and the number of outstanding shares are crucial for calculating this figure. Sources like the New York Stock Exchange (NYSE), major financial news websites (e.g., Yahoo Finance, Google Finance, Bloomberg), and CIT Bank’s investor relations page provide this data.

A direct comparison with competitors requires identifying similar financial institutions with publicly traded stock, then gathering their market caps from the same sources, ensuring consistency in data collection timeframes.

| Year | Market Cap (USD Billions) | Source | Notes |

|---|---|---|---|

| 2023 | [Insert Data] | [Insert Source – e.g., Yahoo Finance] | [Insert Notes, e.g., Data as of October 26, 2023] |

| 2022 | [Insert Data] | [Insert Source] | [Insert Notes] |

| 2021 | [Insert Data] | [Insert Source] | [Insert Notes] |

| 2020 | [Insert Data] | [Insert Source] | [Insert Notes] |

| 2019 | [Insert Data] | [Insert Source] | [Insert Notes] |

Factors Influencing CIT Bank’s Market Cap

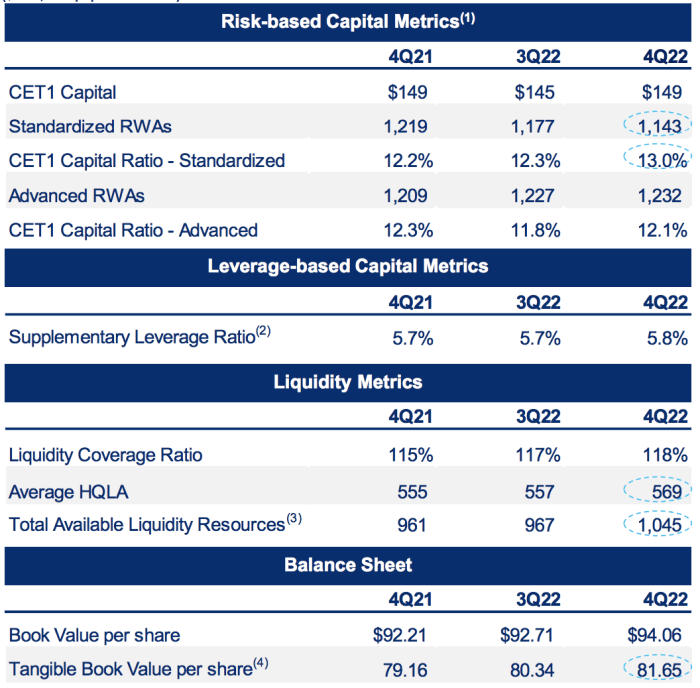

Several key financial metrics and external factors significantly impact CIT Bank’s market capitalization. These include profitability (net income, return on equity), asset quality (loan losses, non-performing assets), capital adequacy (capital ratios), and efficiency (operating expenses). External factors like interest rate fluctuations and broader economic conditions also play a substantial role.

- Interest Rate Changes: CIT Bank’s profitability is directly linked to interest rate spreads. Rising interest rates generally improve profitability, boosting valuation. Conversely, falling rates can compress margins and negatively impact market cap.

- Economic Conditions: Economic downturns increase loan defaults, impacting asset quality and profitability. Recessions typically lead to lower market valuations for banks, including CIT Bank.

- Regulatory Changes: New regulations can increase compliance costs and affect lending practices. Significant regulatory shifts can influence investor confidence and thus market cap.

CIT Bank’s Stock Performance and Market Cap, Cit bank market cap

Source: seekingalpha.com

CIT Bank’s stock price and market capitalization are intrinsically linked. A rising stock price directly increases market cap, and vice versa. Analyzing historical data reveals the correlation between these two metrics. Key events, such as earnings announcements, mergers and acquisitions, and significant economic shifts, often cause substantial fluctuations.

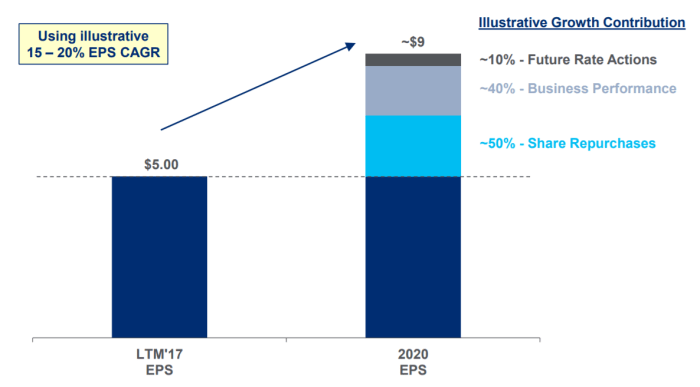

- Timeline of Stock Price and Market Cap Correlation: A detailed chart (description only, no image) would illustrate the historical relationship between CIT Bank’s stock price and market cap, showing periods of growth and decline. This visual would highlight the strong positive correlation between the two.

- Key Events and Fluctuations: Specific examples of events, like unexpected earnings results or changes in regulatory environments, would be detailed to showcase their impact on market cap. For instance, a positive earnings surprise would typically lead to a stock price increase and higher market cap.

- Comparison to a Market Index: Comparing CIT Bank’s market cap performance against a relevant benchmark, such as the S&P 500 Financial Index, would provide context for its relative performance. This comparison helps assess whether CIT Bank’s market cap movements are in line with broader market trends or are unique to the company.

- Impact of Major Announcements: The impact of specific announcements, like quarterly earnings reports or news regarding mergers, would be analyzed. Positive announcements generally lead to increased investor confidence and higher market cap, while negative announcements have the opposite effect.

Investor Sentiment and Market Cap

Source: seekingalpha.com

Investor sentiment plays a crucial role in shaping CIT Bank’s market cap. Positive sentiment leads to increased demand for the stock, driving up the price and market cap. Conversely, negative sentiment can cause selling pressure, reducing the market cap.

- Prevailing Investor Sentiment: A summary of current investor sentiment towards CIT Bank, based on analyst reports and news articles, would provide insight into its impact on market cap. This would involve examining whether the overall sentiment is bullish, bearish, or neutral.

- Influence of News and Analyst Reports: Examples of news articles and analyst reports that significantly influenced investor perception and consequently, the market cap, would be detailed. Positive news often boosts market cap, while negative news can have the opposite effect.

- Significant Investor Actions: Examples of large-scale buying or selling of CIT Bank stock and their resulting effects on the market cap would be presented. Large institutional investors can significantly impact the stock price and market cap.

- Social Media Sentiment: While difficult to quantify precisely, the impact of social media sentiment on investor perception and market cap would be discussed. Significant positive or negative social media buzz can influence investor behavior.

Future Projections of CIT Bank’s Market Cap

Predicting CIT Bank’s future market cap involves considering several factors and making reasonable assumptions. This forecast is not a guarantee, but rather a reasoned projection based on current trends and available data.

- One-Year Forecast: A projected market cap for the next year would be provided, clearly stating the assumptions underlying this prediction. For example, this could include assumptions about interest rate movements, economic growth, and CIT Bank’s own financial performance.

- Underlying Assumptions: The specific assumptions used in the forecast would be detailed, including anticipated interest rate changes, economic growth projections, and estimates of CIT Bank’s revenue and profitability. This transparency helps assess the reliability of the forecast.

- Potential Risks and Uncertainties: Potential risks and uncertainties that could affect the accuracy of the forecast would be acknowledged. These could include unexpected economic downturns, regulatory changes, or unforeseen events impacting CIT Bank’s operations.

- Market Cap Scenarios: A description of potential market cap scenarios would be provided, illustrating different outcomes based on varying levels of risk and uncertainty. For instance, a best-case scenario, a base-case scenario, and a worst-case scenario could be described, each with its corresponding market cap projection.

Conclusive Thoughts: Cit Bank Market Cap

In conclusion, CIT Bank’s market cap reflects a dynamic interplay of internal performance, external economic forces, and prevailing investor sentiment. While past performance offers valuable insights, predicting future market cap requires careful consideration of various factors and a realistic assessment of potential risks and opportunities. This analysis has provided a comprehensive overview of CIT Bank’s market capitalization, offering a framework for understanding its past, present, and potential future.